In my last post I talked about wanting to build a game that could explain how venture capital worked. Why? Because almost every founder I talk to feels there’s some huge mystery to how the industry works.

You could read a book or a blog post but I think a game is a better way to help founders instinctively understand how and why VCs behave the way they do. Plus it’s more fun.

The game is super early stage but since my last post I’ve play tested it at two founder events. I’ve now seen real people playing Swagger.vc and having fun!

Playing it in a workshop setting meant creating 10 sets of cards. Which meant 540 cards. Which I had to shuffle by hand in my hotel room the night before. Which required beer.

Why the name Swagger?

I do not think anyone who knows a VC needs me to explain this.

Thanks for reading A Leap of Faith. Subscribe for articles on pitching, funding and founder storytelling.

What the game looks like

Here’s what the game currently looks like and an explanation of how the cards work.

Companies

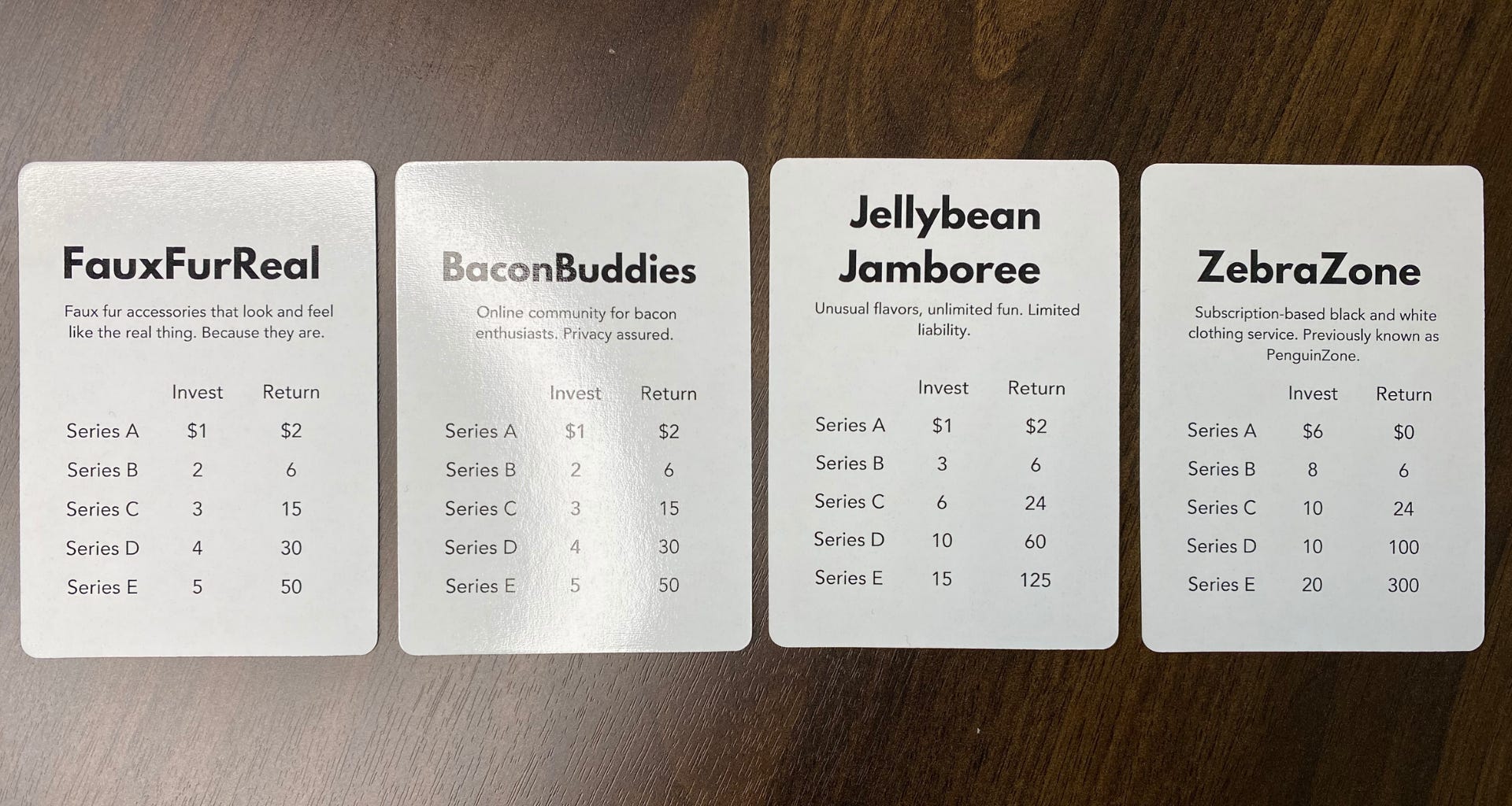

There are currently 54 unique companies modelled after Monopoly cards. Instead of rising rents I have fundraising series from A to E. Each startup has its own capital needs and return potential.

It’s a bit deterministic to print the amounts in advance but it allowed me to create lean companies with smaller exits (FauxFurReal), capital-heavy companies with potentially huge late-stage exits (ZebraZone), and everything in between.

Events

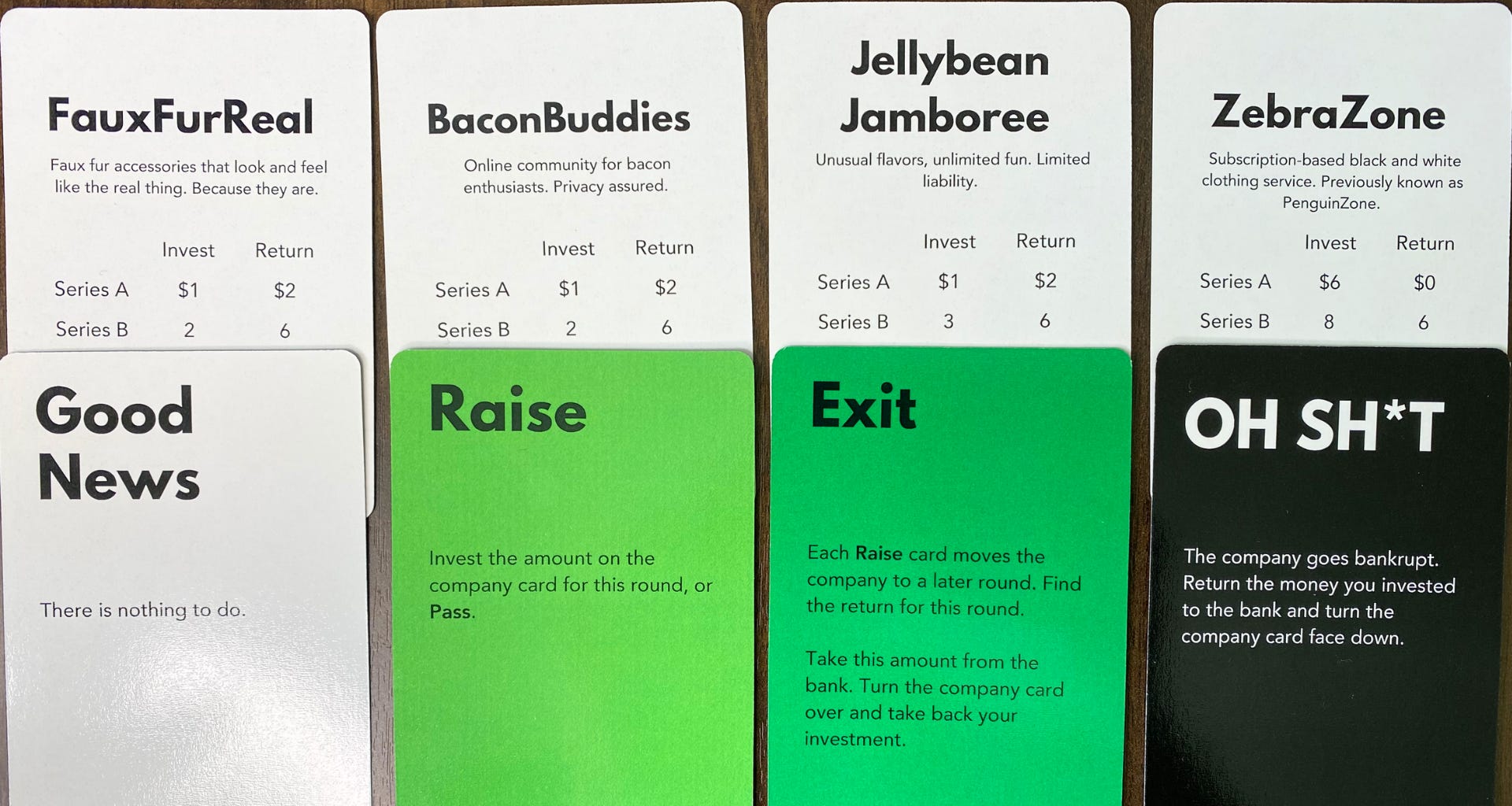

The game is played in rounds with one round equal to one year. Each round an Event card is turned over for each startup in the player’s portfolio. Different things can happen.

Good News - Basically nothing happens to this company. It’s great in some circumstances, not so much if you’re desperate for an exit.

Raise - The company raises money. As an investor, you need to invest the next round amount.

Exit - The company is sold for the return of its current round, e.g. Series C. This allows players to recycle capital in early rounds, or generate good returns in late rounds.

Oh Sh*t - This company goes out of business. Later I will update the cards with all the fun scenarios this can happen.

Special Cards

Veto - players can veto an Oh Sh*t, Exit, or a Raise event.

Pass - if a player does not want to invest, or cannot, they place a Pass card (but there’s a chance the company goes bankrupt).

Rules of the Game

Initial Setup

- Portfolio of 10 cards

- $120M fund size

- Event cards seeded with 54 Good News, 31 Raise, 8 Exits and 8 Oh Sh*t (the probabilities can be modified by adding/removing cards to make the game easier or more difficult)

How to Play

- The basic game involves choosing or randomly dealing 10 Company cards. This is the fund’s portfolio.

- Each time a new Company is added the player must invest the Series A amount.

- Each of the 10 rounds of the game involves turning over one Event card per company. If a Raise card is turned over, the player invests (or passes).

- If an Exit card is turned over the player gets the return on the card for that round, and returns their capital back to their fund.

- An Oh Sh*t means bankruptcy, unless a Veto card is played. Who cares if it’s realistic for a VC to veto failure. It feels good!

- Anytime a company is at Series E and gets either another Raise card or an Exit card there is an IPO! There are three types of public offerings: regular, big and huge. Huge equals 3x the Series E return amount. Winning the game usually requires IPOs.

- At the end of 10 rounds each player calculates their fund return. That is simply the money left in their fund after all exits are calculated.

- Any companies who did not go bankrupt but also did not exit are in the “unrealized returns” category. There might be a version of the game where players can raise multiple funds. Or mark to market. Or just accept that illiquid company shares do not count towards a win.

To mix things up, in my workshop I gave each fund only 5 starting companies at random. Then I forced them to bid for the remaining company cards. Highest bidder won. This was really fun. And loud.

Observations

Core mechanics

I thought the overall mechanics were not bad. The game is currently simple enough to grasp quickly and most people figured out how to play it solitaire style on their own.

Cards have some drawbacks (see shuffling 540 cards above). But one advantage is being able to print the instructions on the card vs a rulebook. I hate rulebooks.

With cards there’s no need for a game board. But you need a big enough table.

The probabilities of exit (8%), bankruptcy (8%) and fundraising (31%) ended up creating fairly realistic fund outcomes over 10 years. More on that below.

Education Value

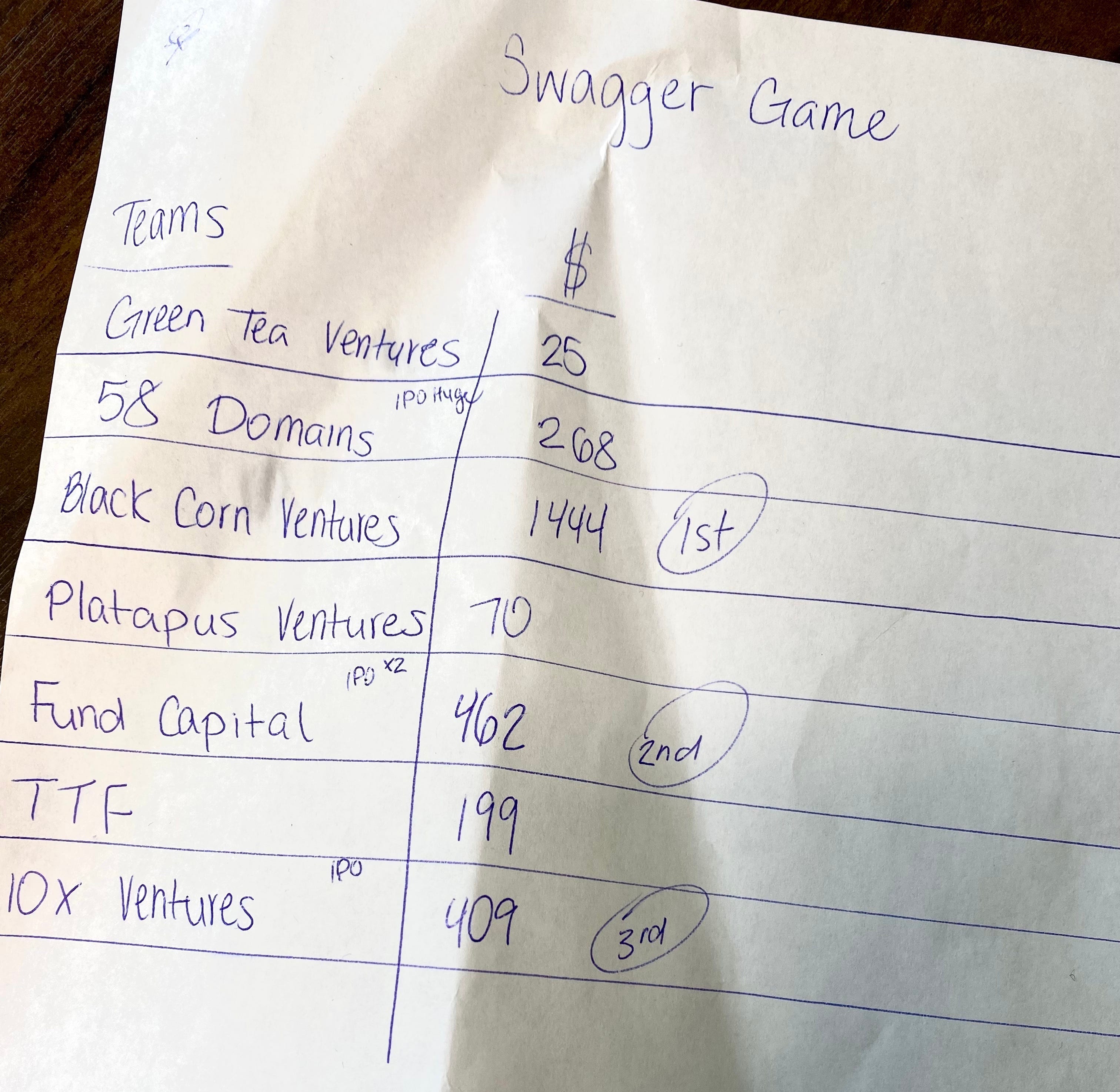

As a game designed to teach people about power law returns I couldn’t have asked for a better result. One fund, Black Corn Ventures, generated a 12x return. Two funds did not return the fund. The rest fell between 2-3.8x return.

Some founders complained the outcome was too random or unfair, which I felt was true from a gameplay perspective. But returns were realistic. 20 faux fund managers figured this out in an hour vs deploying $840M and finding this out after a decade.

One of the funds, 58 Domains, had an IPO but still only generated a 2x return overall. That’s because the company that went public was a capital efficient company. The rest of the portfolio involved 3 failures, and a few early exits.

This was a good example of how even achieving a ‘moonshot’ with 10% of the portfolio does not guarantee a big fund return. As a reminder, a 3x fund return is still only 12% IRR.

The necessity to compete for deal flow introduced the concept of deal scarcity and timing: the smart players figured out quickly that they needed to build a big portfolio early, even if they had to overpay to get into a hot deal.

And no, my game does not model 2% management fees, hurdles, TVPI or other non-fun concepts.

As a whole returns were actually too high relative to venture norms. We don’t want founders thinking VC is easy.

Fun Value

I’ve already mentioned how fun competitive bidding on deals was. This made the game competitive and social. I’m going to keep this in the game.

Currently the least successful part of the game is the feeling that the outcome is random. From an educational point of view, it’s fine to point out that VCs have a poor track record of picking winners, especially early. So a well-constructed portfolio strategy takes this into account.

But I’d like to find a way to increase player control, even if it is the illusion of control. I want people to feel invested (pun intended) in their companies. That could be by expanding player actions, which are currently only Veto or Pass, to include more role-play type actions. Or it might require a complete re-thinking of the game.

I also want to find more ways for players to pick different strategies and have a chance to win. If everyone picks just the largest portfolio the game will truly be determined by luck. I have some ideas around early vs late-stage funds or funds that focus on one industry.

Next Steps

I’m getting more people reaching out to me asking to play test Swagger.vc which is great. It would be fun to pit founders vs VCs!

I’m still sticking to my mission to create a game that is both educational and fun. That will make the journey more difficult, but it’s what I care about.

Whatever I’ve shown here will likely be obsolete by the time the next play test happens. The next version of the game could be completely different.

Post a comment or reach out if you have ideas on how to make this game better, or if you want to play.